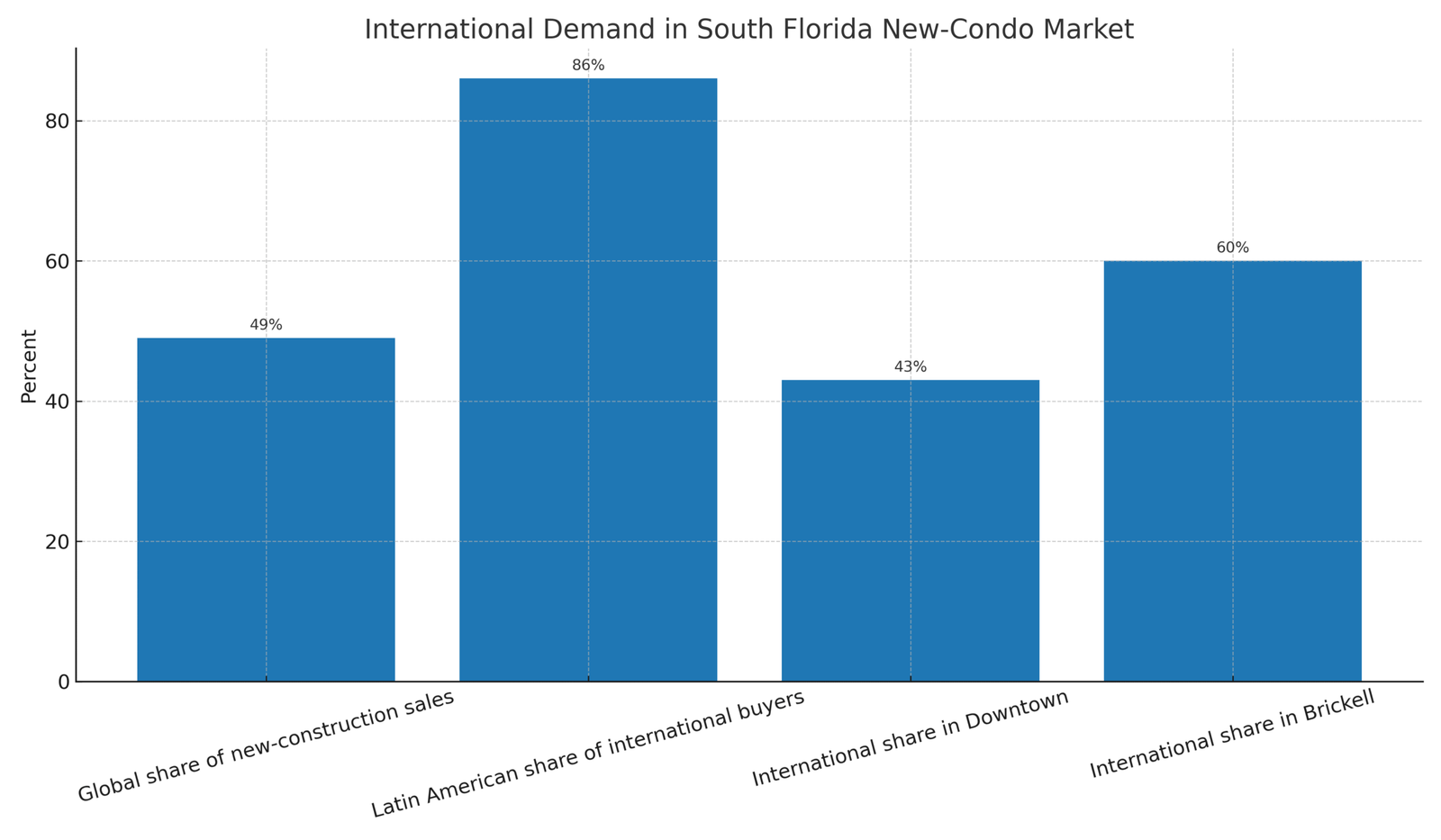

Miami’s ultra-luxury condo market has entered a decisive phase: global capital—particularly from Latin America—is now the cornerstone of new-construction demand. The latest MIAMI REALTORS® collaboration across 37 projects shows international buyers purchased 49% of South Florida’s new-construction, pre-construction, and conversion condos during the 18 months ending June 2025 (data from 9,115 units). This is a structural shift that materially supports absorption at the top of the market. MIAMI REALTORS®

Just as important is the composition: ~86% of those international purchases were by Latin American buyers. In submarket detail, Downtown Miami’s international buyers were 99% Latin American; Coconut Grove 97%; Southeast Broward 84%; West Palm Beach 89%. Within Downtown, international purchasers represented 43% of all units sold during the window analyzed. Together, this paints a clear picture of who is setting the pace. MIAMI REALTORS®

A separate analysis underscores the urban-core concentration: since January 2024, nearly 80% of South Florida’s new-construction condo sales occurred in Downtown/Brickell, with foreign-buyer shares of 43% (Downtown) and 60% (Brickell). In other words, the deepest pools of global, often all-cash demand are in the city center—a key signal for long-run liquidity and pricing power in flagship towers. Homes.com

The U.S. backdrop corroborates this strength. In the year through March 2025, foreign buyers purchased 78,100 U.S. homes (+44% YoY) with a record $494,400 median price, and Florida captured 21% of all foreign transactions. Notably, 47% of those purchases were all-cash, a dynamic that compresses timelines and elevates certainty in competitive releases. Mansion Global

Why Latin American buyers favor Miami now

- Capital preservation in USD + staged deposits. Pre-construction schedules allow deposits over time in dollars—useful for cross-border capital planning and FX management. MIAMI REALTORS®

- Policy and currency push factors. Political shifts and weaker local currencies across parts of LATAM continue to nudge wealth toward dollar-denominated hard assets. MIAMI REALTORS® even notes, illustratively, “1 Brazilian real ≈ $0.18 USD” at the time of publication. MIAMI REALTORS®

- A long record of appreciation. Miami-Dade condos have posted 14 consecutive years of price appreciation, reinforcing the “safe-harbor” thesis for prime product. MIAMI REALTORS®

What this means for $2M–$10M+ pre-construction

- Pricing power for flagships. With ~half of new-construction sales going to global buyers, best-in-class projects in Brickell, Downtown, Grove/Gables, and select beachfronts maintain leverage—especially on trophy view lines and branded-service stacks. MIAMI REALTORS®

- iquidity where demand concentrates. Downtown/Brickell’s ~80% share of recent new-construction sales signals deeper resale markets—vital for capital preservation. Homes.com

3. Cash reshapes negotiations. With 47% cash among international U.S. purchases, buyers can move faster, negotiate certainty, and secure best-stack selections more reliably. Mansion Global

Buyer playbook (U.S. & LATAM)

- Move early on tier-one lines. Pre-release and contract phases reward decisiveness on exposures with moat-like desirability (unobstructed bay/ocean, corner stacks, marina adjacency). Downtown/Brickell offers depth; Grove/Gables offers velocity and lifestyle. Homes.com

- Engineer deposits around FX. Align staged payments with capital flows and currency windows; for cross-border buyers this is a meaningful ROI lever. MIAMI REALTORS®

- Underwrite building health. Newer systems, strong reserves, and professional management reduce long-run ownership friction—especially important at $5M–$10M+.

(See Q2-2025 market conditions in Post #2.) CondoBlackBook

Request a curated pre-construction brief with tier-one line availability, deposit structures, and FX-smart strategies.

Sources & Citations

- MIAMI REALTORS® (July 21, 2025), “New International Report: Global Buyers Purchase 49% of South Florida New Construction Units, Majority by Latin Americans.” https://www.miamirealtors.com/2025/07/21/new-international-report-global-buyers-purchase-49-of-south-florida-new-construction-units-majority-by-latin-americans/ MIAMI REALTORS®

- Homes.com (July 30, 2025), “Foreign buyers dominate Miami’s new condo market.” https://www.homes.com/news/foreign-buyers-dominate-miamis-new-condo-market/390282381/ Homes.com

- Mansion Global (July 14, 2025), “Foreign Purchases of U.S. Homes Surged in the Year Through March.” https://www.mansionglobal.com/articles/foreign-purchases-of-u-s-homes-surged-in-the-year-through-march-c32290a4 Mansion Global