At the ultra-luxury level, “value” isn’t the lowest price—it’s the best long-run equation of views, privacy, services, club reciprocity, marina access, structural quality, and liquidity. Q2-2025 provides an unusually clear backdrop: buyer-friendly inventory with resilient pricing where quality is highest.

Market context (≥$1M): Q2-2025 recorded 418 closings (-9.9% YoY; +14.5% QoQ), a median price ~$1.93M (+10.1% YoY), median $/SF $1,027 (+3.1% YoY; −4.7% QoQ), DOM ~94 days, and 19 months of inventory—conclusive signs of a buyer’s market with leverage for the well-prepared. CondoBlackBook

$2M+ segment: 203 sales (flat YoY), $1,544/SF (+6.3% YoY), 111 DOM—evidence of a selective but durable high-end pool. The $5M+ cohort carried much of the quarter’s momentum. CondoBlackBook

Submarket signals that drive decisions

Fisher Island (ultra-prime scarcity): Miami’s $/SF apex; $2,369/SF in Q2-2025 (+15% YoY). For collectors prioritizing privacy, yacht access, and club life, Fisher Island’s scarcity premium is the thesis—and the defense. CondoBlackBook

Coconut Grove & Coral Gables (lifestyle + speed): The only major submarket with YoY sales growth (+8.8%), and fastest to contract (~53 DOM). Low-density streetscapes near top schools and marinas continue to outperform. Inventory ~12 months, the tightest among the three. CondoBlackBook

Greater Downtown/Brickell (scale + optionality): The most accessible entry point to luxury on a $/SF basis (Downtown ~$754/SF; Greater Downtown $882/SF) with ~25 months of inventory—ample selection for view-first buyers and negotiated finishes. CondoBlackBook

Why this adds up to “value” (beyond price)

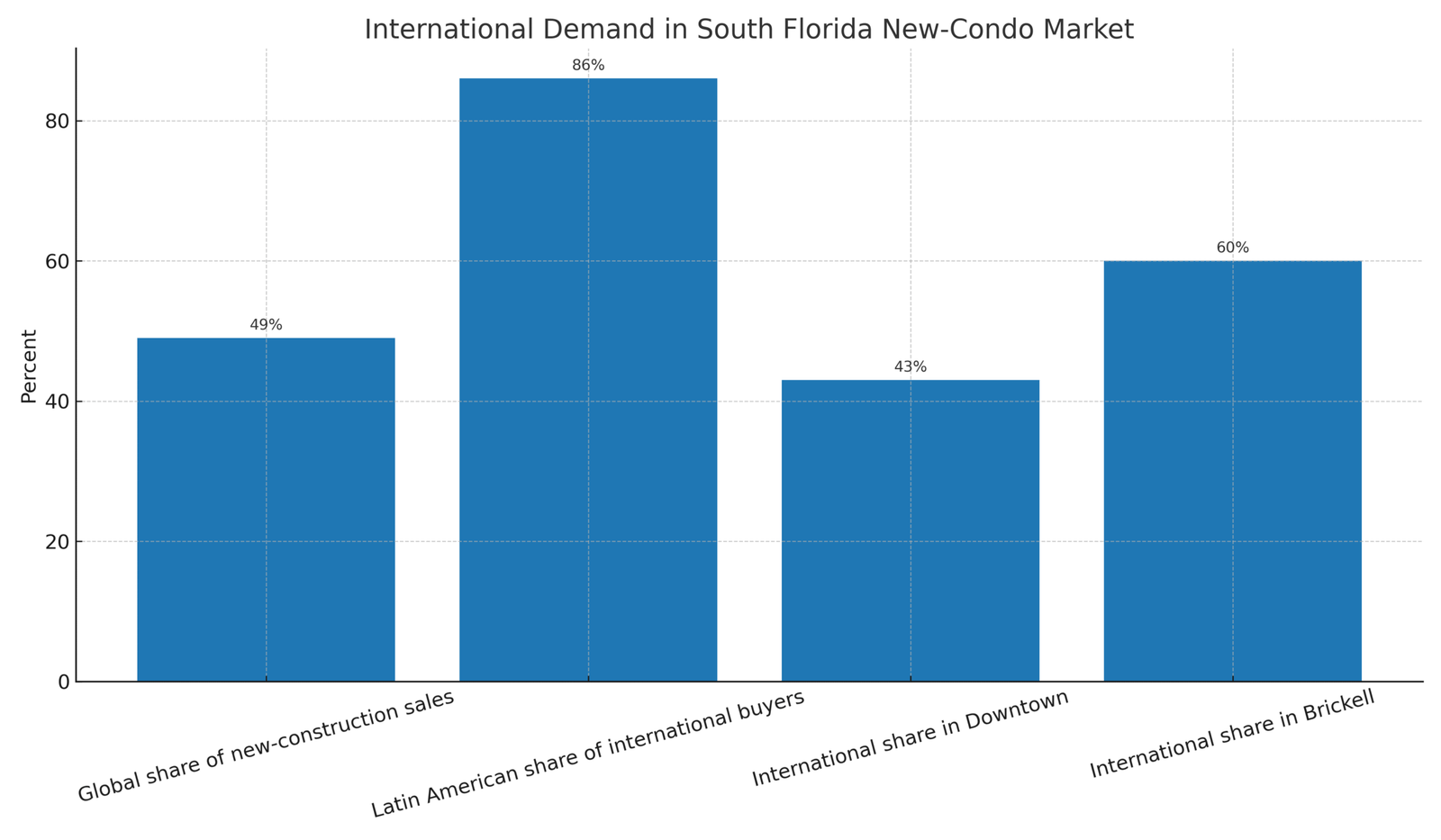

- Liquidity/exit options. Since January 2024, ~80% of new-construction condo sales were in Downtown/Brickell, where foreign-buyer shares hit 43% (Downtown) and 60% (Brickell). Depth supports resale confidence. Homes.com

- Structural quality & reserves. Newer towers (2015–2025 deliveries) with modern envelopes and funded reserves deserve a pricing premium that pays back in fewer surprises. CondoBlackBook

- Policy clarity. New Florida legislation (e.g., HB 913 / HB 939) is stabilizing reserve management and fee flexibility, improving long-run ownership calculus for condos. CondoBlackBook

Practical frameworks by budget band

$2M–$4.9M:

- Target Greater Downtown for skyline drama and hotel-grade amenities at a relative $/SF discount. Use inventory depth to negotiate finish packages, storage rooms, and assignment flexibility. CondoBlackBook

$5M–$9.9M:

- Favor architectural distinctiveness + marina adjacency. At this tier, design pedigree and view corridors defend $/SF through cycles; track DOM outliers line-by-line for value entries. CondoBlackBook

$10M–$15M+:

- Decide between scarcity premium (Fisher Island) and lifestyle velocity (Grove/Gables). Let hold horizon and usage pattern (primary vs. seasonal) guide the call. CondoBlackBook

Contact us today to explore the best pre-construction opportunities in Miami.

Sources & Citations

- CondoBlackBook (Aug 1, 2025), “Q2 2025 Miami Luxury Condo Market Summary: Mixed High Season, Modest Price Gains in Buyer’s Market.” https://www.condoblackbook.com/blog/q2-2025-miami-luxury-condo-market-summary-mixed-high-season-modest-price-gains-in-buyer-s-market/ CondoBlackBook

- Homes.com (July 30, 2025), “Foreign buyers dominate Miami’s new condo market.” https://www.homes.com/news/foreign-buyers-dominate-miamis-new-condo-market/390282381/ Homes.com